Everything you need to know about affiliate marketing, including how to get started, different methods, and things to watch out for are all below. Let’s get started!

Affiliate marketing is the easiest way to generate an income online. You don’t need to create your own products (which takes a ton of time), and you don’t even need to really sell anything.

All you need to know how to do is to recommend something, and if you’ve ever recommended anything to anyone before, then you already know how to do this.

I’ve been affiliate marketing since 2009 on my very first website, GreenExamAcademy.com. On this architecture-education website I promoted an exam software that has generated more than $200,000 in commissions over the years.

And that’s just one product out of dozens of products I’ve recommended across multiple businesses. All together, I’ve generated over 3 million dollars since 2009. That’s not total sales, that’s total commission that I got to keep.

I know, this sounds kind of wild, and almost too good to be true. You’re not going to make millions of dollars overnight – this stuff takes time to learn what works, and what doesn’t. But, I’m here to help you speed up the process and finally get the momentum going your way.

In this guide, I’ll teach you how to get started and find the right products for your audience, even if you’re just starting out.

Instead of worrying about upsetting and annoying your audience with your promotions, I’ll show you how to gracefully promote products in a way that people will thank you for the time and effort you put in to help them make a buying decision.

I’ll also teach you about the amazing opportunities you can have related to the companies you help promote, and the special kinds of deals and offers you can get for yourself, and your audience, through those relationships.

It’s the guide I wish I’d had when I started my affiliate marketing journey way back in 2009.

Excited? Here’s what’s in store:

Contents

- What is Affiliate Marketing?

- How Does Affiliate Marketing Work?

- Benefits of Affiliate Marketing (and Drawbacks)

- How Much Do Affiliate Marketers Make?

- What Affiliate Marketing Strategies Do Marketers Use to Promote Their Partners?

- How to Start Affiliate Marketing for Beginners

- Affiliate Marketing Examples

- Affiliate Marketing Case Study: SPI + ConvertKit

- 8 Best Affiliate Programs and Networks

- Affiliate Marketing Tips for Beginners (and Experts)

- Affiliate Marketing Mistakes to Avoid

- My Best Resource for Beginner Affiliate Marketers: The Affiliate Marketing Cheat Sheet

What Is Affiliate Marketing in Simple Terms?

Affiliate marketing is the process of earning a commission by promoting another person’s (or company’s) product. You find a product you like, promote it to your audience, and earn a piece of the profit for each sale that you make.

It’s similar to a salesperson earning a commission, except you don’t work for the company. Instead, it’s like earning a reward for sending a new customer to the company.

In other words, when you help another company generate sales, you get a cut!

The best part is that you don’t have to spend the time and money to create your own products, because someone else has already done the hard work.

You can begin making money as an affiliate as soon as you have a place to recommend products, whether that’s a website you have, a podcast you’ve started, or even on social media.

So, all you have to do is send traffic through a link to that product, and everything after that is out of your hands . . . right?

Wrong.

There’s so much more involved to make this work well, which is why most people who attempt affiliate marketing fail, or just see a few dollars coming in from their efforts.

I want you to see amazing, life-changing results from affiliate marketing, which is why I’m thankful you’re here.

There are two ways to be involved in affiliate marketing—either as a product owner/affiliate marketing program creator or an affiliate marketer.

In this post, we’re going to focus on how to do online affiliate marketing from the affiliate marketer side.

Affiliate marketing is quite simply one of the most powerful ways to generate an income online. Regardless of your niche, the upside with affiliate marketing is nearly limitless if you go about it the right way!

Part of the beauty of affiliate marketing, especially for beginners, is you don’t have to invest time in creating the products that will be serving your audience—because, guess what?

Those products likely already exist.

Because of that, affiliate marketing is an opportunity anyone can take advantage of, and it’s easy to get started.

Affiliate marketing examples are all around us—and you’ve probably been involved in affiliate marketing without realizing it!

If you’ve ever clicked on a link in a blog post to a product or service being offered on another website, there’s a good chance the owner of the website where you originally clicked the link received a commission from your purchase.

Yes, affiliate marketing is everywhere—but here’s the thing: few people understand how to take full advantage of it.

In fact, I believe affiliate marketing is the world’s most untapped source for generating passive income!

It’s a beautiful process that’s completely underutilized, and I’m excited to share with you exactly how it all works.

Who Is a Good Fit for Affiliate Marketing?

Affiliate marketing can be a great choice for online entrepreneurs, bloggers, and really anyone who has a website and is willing to build an audience they can serve authentically.

If this describes you, products exist right now that people in your target market are probably already buying, and if you can become the resource that recommends those products, you can generate a commission as a result.

Affiliate marketing can be an especially good option if you’re not ready to create your own product or service, but you want to serve your audience by recommending products that may be helpful to them.

Online affiliate marketing can also be a good fit for a wide range of people because you can apply a bunch of different marketing methods to promote affiliate products and services.

These include the same marketing methods you may already be using—things like search engine optimization (SEO), paid search engine marketing (SEM), email marketing, content marketing, and display ads.

You can even take advantage of other nifty ways to market products, like product reviews and unboxings.

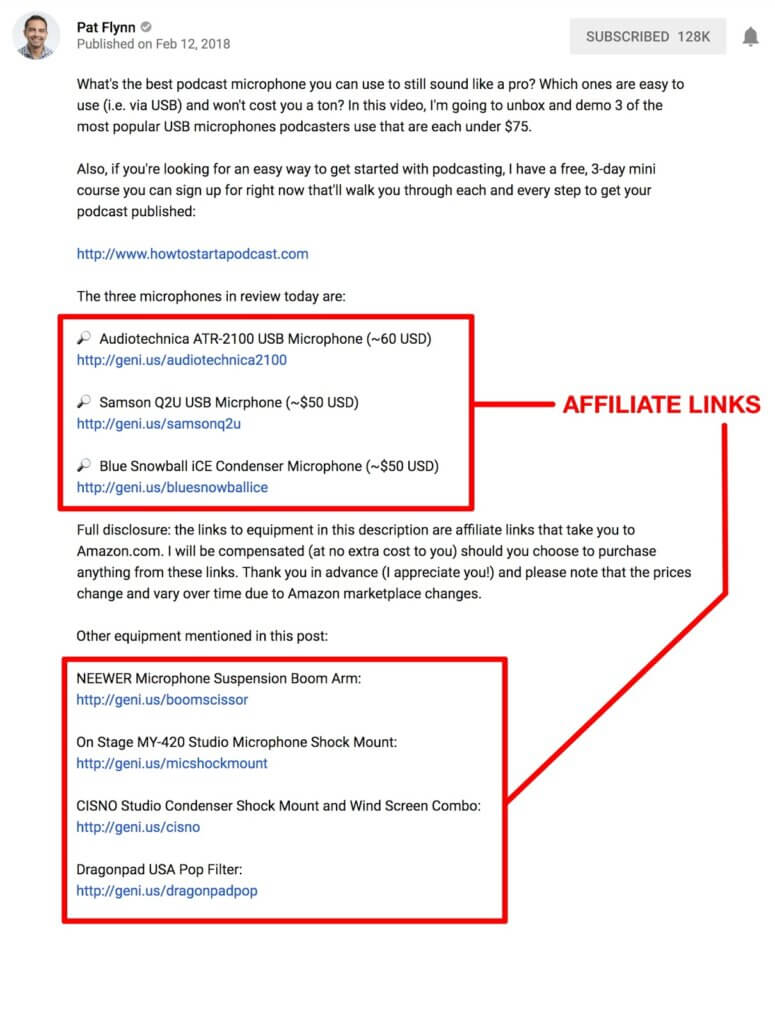

Take for instance this YouTube video I did, where I review and demonstrate three USB podcasting microphones and include Amazon affiliate program links to purchase each one in the description.

Finally, it’s important to remember that affiliate marketing works best when you’re sincere and confident about the product you’re promoting.

You’d only sell your own product if you knew it could help people, and it’s the same with affiliate marketing. If you go in with a get-rich-quick mentality, you’re not going to be impressed with your results.

How Does Affiliate Marketing Work?

Let’s get into the details of how affiliate marketing works. There are three main players in an affiliate marketing arrangement:

- You and your website—the “affiliate.”

- The affiliate company (or network). In the simplest affiliate arrangements, you work directly with a single company to promote one or more of their products. There are more complex affiliate networks that provide an opportunity to earn affiliate revenue on a range of products, such as Amazon, Impact, and ShareASale.

- The customer. This is a member of your audience who uses your affiliate link to purchase a product from the affiliate company or network.

A company that offers an affiliate marketing program may call it by a different name—these programs are also commonly called partner programs or referral programs.

Here’s how each party benefits from affiliate marketing:

- From your recommendation, your audience learns about a product, course, or tool that may be useful to them;

- From your recommendation, the company selling the product, course, or tool gets new customers they may not have found otherwise;

- As a result of the sales to your audience, the company gives you a commission.

When done the right way, affiliate marketing can be a win–win–win.

But at the center of this is one thing: your audience’s trust.

When your audience believes you have their best interests at heart and trusts your recommendations, then all three parties in the affiliate marketing relationship ultimately benefit.

A lot of people worry about getting involved with affiliate marketing because it might make them look slimy or too salesy.

That’s why I’ve made it part of my mission to teach people how to do affiliate marketing in a way that makes it a win for everyone.

The biggest element to success with affiliate marketing?

Trust.

Earn trust from your audience first, and only recommend affiliate products that you’ve used yourself and know your audience will benefit from.

And you know what?

A lot of people do it the wrong way by taking an income-first rather than a serve-first approach.

These folks push random products and over-promote them without providing true value to their audience.

This has given affiliate marketing a really bad rap in some quarters, causing many ethically minded entrepreneurs to be wary of affiliate marketing.

But thankfully, you CAN do it right, maintaining your audience’s trust and having them thank you for your recommendations.

Benefits of Affiliate Marketing (and Drawbacks)

As with anything, affiliate marketing has its upsides and its downsides.

Later in this guide, I’ll give you the guidance you need to go about affiliate marketing smartly so you can make the most of the opportunities out there and avoid the potential downsides.

Here are the main pros and cons of affiliate marketing.

Affiliate Marketing Pros

- Low barrier to entry. Affiliate marketing is easy to get started with, and costs little. Most affiliate programs are free to join, and you don’t have to create, stock, or ship products, which also means less hassle/responsibility.

- Low risk. You’re not the product owner, so you don’t lose anything if a customer doesn’t buy.

- Passive income potential. Affiliate marketing provides the potential for passive income.

- More freedom. When you start earning passive income, you can work anytime and from anywhere, as long as you have internet access.

Affiliate Marketing Cons

- Not a quick fix. It can take time to generate the amount of traffic needed to result in substantial income.

- Less control. You don’t own or control the product/service you’re recommending, so you can’t control the quality or customer experience.

- Competition and audience fatigue. An attractive affiliate program means you might be competing with others for customers.

- Offer fatigue. Audiences can also get “offer fatigue” if they see too much ongoing promotion from you.

- Not all affiliate programs are created equal. While most companies that offer affiliate commissions are stable and ethical, there are shady companies out there too, some of which may not pay what they say they will. It’s important to do your homework.

- Risk of link hijacking. Unscrupulous individuals may hijack your affiliate links, known as “clickjacking,” potentially stealing your commission in the process.

How Much Do Affiliate Marketers Make?

The beauty of affiliate marketing is that you don’t have to invest the time and effort to create a product to sell.

You can begin selling something as an affiliate as soon as you have a platform to sell it on. In this way, affiliate marketing can be a great way to earn some extra income without a lot of hassle or upfront cost.

That said, it’s not a way to get rich quick.

Like all passive income ideas, it takes time and effort to create a decent revenue stream.

Although affiliate marketing has been my number one source of income for a while, it took me a while to get to where I am, including building close relationships with the companies I’m an affiliate for.

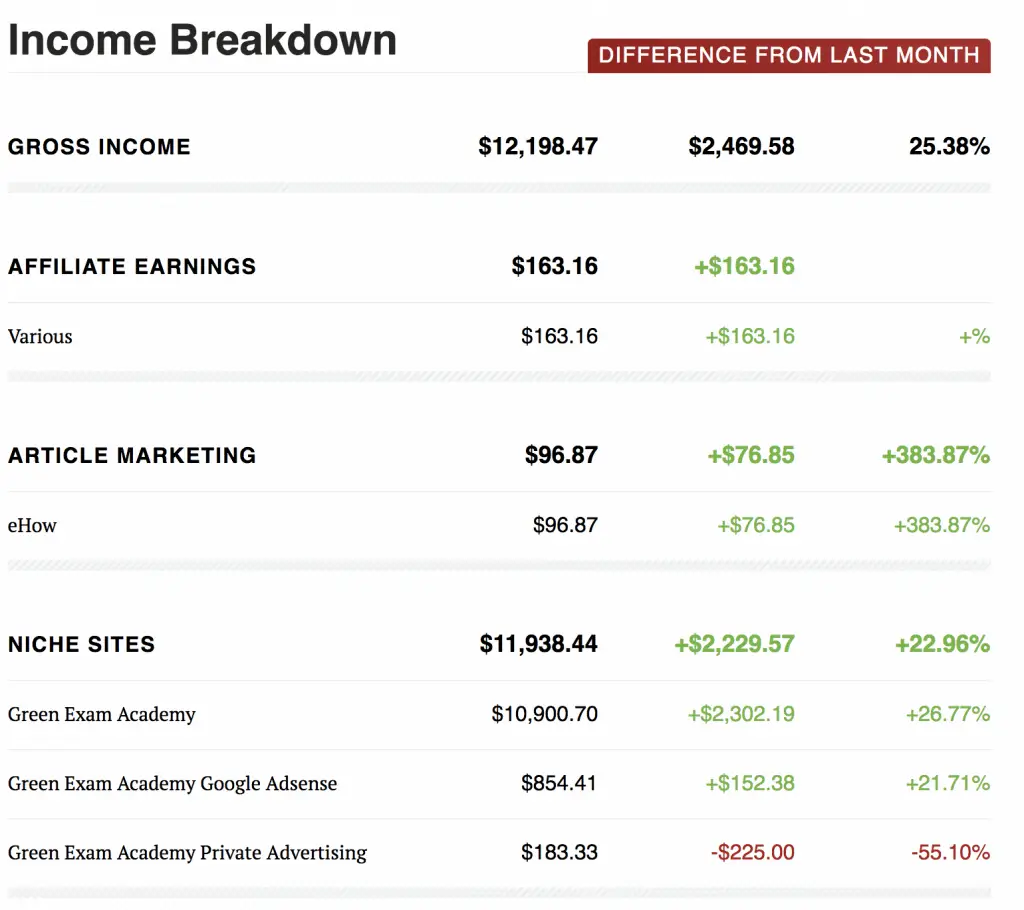

In my very first month doing affiliate marketing (December 2008), I earned a whopping $163.16:

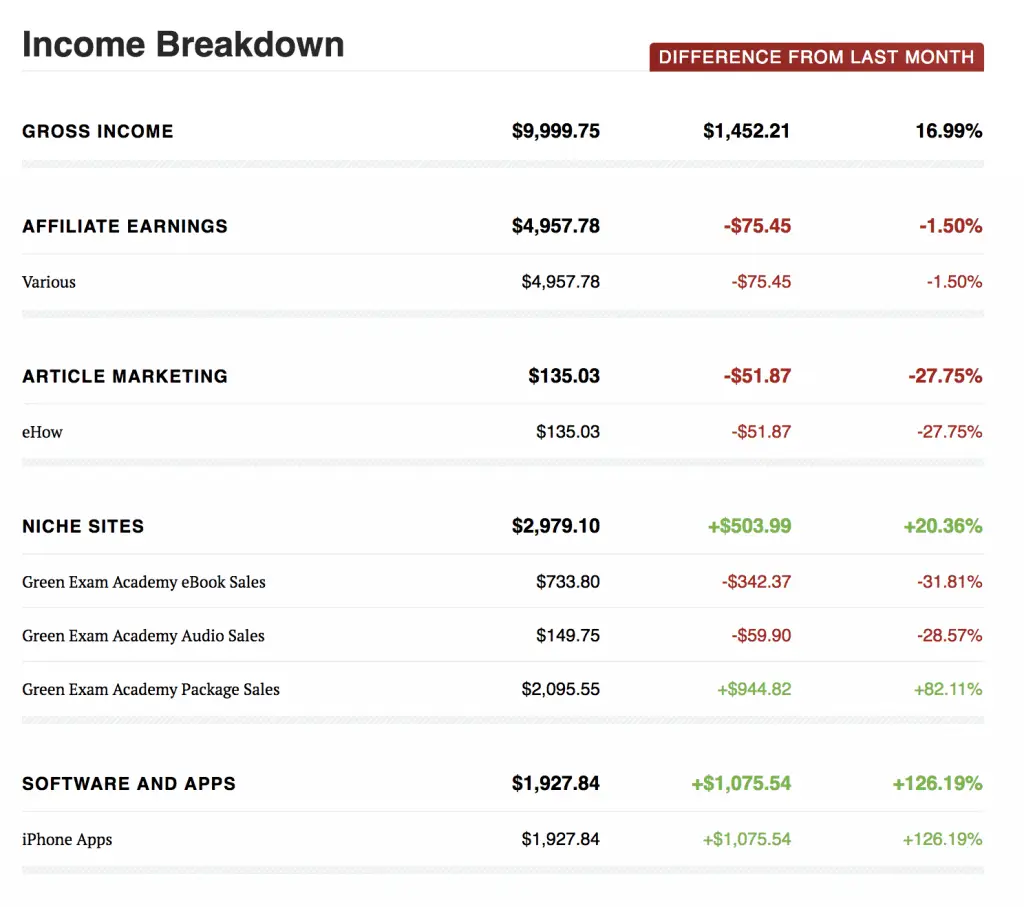

Here’s how I did in December 2009, the month that marked my first full year as an affiliate marketer:

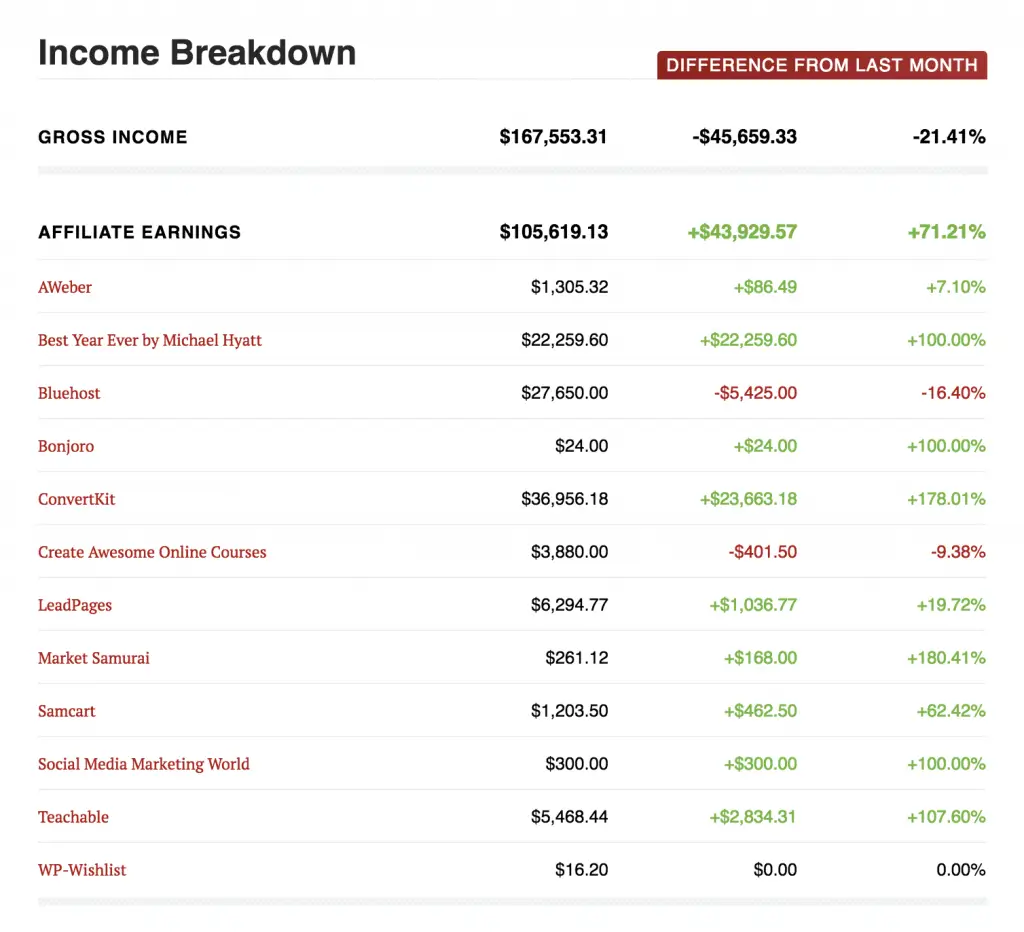

And here’s what my affiliate income looked like in December 2017, the last month I published an income report:

As you can see, I’ve done really well with affiliate marketing in the past 10 years—but it’s taken a lot of time and hard work to get to that point.

So, how much can you make once you’re up and running with affiliate marketing?

That depends primarily on how committed you are to making it work and how much time, energy, and focus you’re willing to put into it. It also hinges on a few other factors:

- The commission percentage you receive for each sale of an affiliate product or service.

- The size of your audience.

- How successful you are at promoting those products or services to your audience.

- Typical commission percentages vary depending on the affiliate company you partner with, and the types of products or services you’re promoting.

Digital products and services typically offer higher margins due to their lower costs of production and fulfillment—there are no raw materials, manufacturing, shelf space, shipping costs, etc.

These margins can be as high as 50 percent.

On the other hand, because of all the aforementioned costs, physical products tend to offer lower percentage margins, sometimes in the single digits.

Thankfully, there is no real limit on how much you can make as an affiliate marketer.

Affiliate marketing can be a great way to augment your existing income, or even become your main source of income if you’re willing to make the commitment.

But in either case, if you’re looking for long-term success with affiliate marketing, you have to be willing to do it the right way.

What Affiliate Marketing Strategies Do Marketers Use to Promote Their Partners?

There are a ton of tactics you can use to promote your affiliate partner’s products online.

Here’s a starter list of 10 to get your affiliate marketer brain something to chew on and remix:

1. Create An Epic Post

One thing I like to do when promoting a product is create an Epic Post about it.

What’s an epic post?

Think of it as a potential one-stop-shop resource for this particular product—not just a review of it, but a full-fledged introduction, how-to, FAQ, best practices, and troubleshooting resource for anyone who purchases the product.

If you can show this much information to people before they make a purchase, they’ll be more likely to actually make a purchase.

At the same time, the epic post becomes an extremely shareable article, one with the potential to rank high for the particular product keyword in Google.

In this epic post, I’d go all out and . . .

2. Create Multiple YouTube Videos About The Product

These videos should be embedded in the epic post.

This is an important affiliate marketing strategy because YouTube is the #2 search engine in the world. You can get a lot of traffic coming in through your affiliate link on YouTube, and the videos themselves can rank in Google too.

Plus, by shooting multiple videos about a particular product, you create even more SEO opportunities.

Make sure to include your affiliate link in the video description, ideally in the first part of the description, so people don’t have to click on “show more” or “read more” to see it.

What should you cover in these videos?

I recommend recording yourself from start to finish with it, then break it up into chunks. People like to watch shorter videos, so this works in your favor, and you get multiple opportunities to rank for various keywords related to that product.

If it’s a digital product, start at the moment of purchase and walk people through the entire process. And if you’re doing a physical product, consider an unboxing video.

3. Host a Webinar

One way to take your affiliate product promotion to the next level is to host a webinar for it.

Webinars are an extremely powerful way to share a message with your audience. They’re personable, they’re live, and you can treat them like an actual event. That way, your promotion becomes a much bigger deal than just a regular affiliate link you dropped into a post.

Combine this with tip #15 in my list below, and have the owner of the product share high-value information, and even answer people’s questions directly on the webinar, and you’ve got yourself a winner.

4. Publish a Webinar Replay

Be sure to record your live webinar so that you can embed it on your website as a replay for those who didn’t watch it live, as well as those who did watch it live but want to review the information.

To be honest, more people will probably watch it as a replay than live, and that’s a good thing—you just have to give them the opportunity to do so.

I recommend recording using screen capture software like Camtasia Studio or Screenflow.

Here’s an example of a blog post on my site containing a webinar replay—one I recorded with Clay Collins of Leadpages, a company for which I’m an affiliate:

Finally, make sure that in the webinar and on the post where you embed the replay, you give people multiple opportunities to click on your affiliate link.

5. Give Away A Bonus

This is probably one of the more underutilized tips I have to share today—but probably one of the most powerful too.

In addition to promoting the affiliate product, give away a bonus to all of those who purchase the product through your link as a thank you.

Chances are, you’re not the only one promoting that product, so to get people to buy from you instead of the other guy, throw in a bonus that can only come with a purchase through your link.

Just have your audience members send you their receipt via email and then you can reply with the bonus, or information about how to access it.

So what could that bonus be?

Maybe it’s a special webinar that shows people how to use the product with a Q&A session at the end of it. Imagine being able to purchase a product, getting familiar with it, and then a couple of days later having access to a webinar that shows you exactly how to use the product, with an opportunity to ask questions about it. How awesome would that be?

Maybe the bonus is another product or piece of software that you have that complements the affiliate product.

Maybe it’s a discount you work out with the owner of the product, one that provides incentive to purchase from you.

Maybe it’s a coupon code or discount to another product you own or have ties to.

Maybe it’s a PDF quick-start guide with instructions and best practices for that product, or access to a website with videos with the same guidance.

You’re adding value to the purchase, making your buyers feel comfortable, and helping get those on the fence from “I’m not sure if this is right for me” to “This is exactly what I need, and more.”

6. Promote Your Products Indirectly On Social Media

Although your website is the centerpiece of your affiliate marketing strategy, social media—Facebook, Twitter, LinkedIn, Instagram, etc.—can play an important role in your affiliate marketing strategy too.

The thing about social media—at least in my experience and in the experience of many other people I know—is that if you directly promote on your social media platforms, you’re not going to get a good response.

People on social media are typically there to be social, not to be sold to.

But all is not lost in the affiliate marketing world, because you can do an indirect social media push, which means instead of directly linking to your affiliate links on Facebook or Twitter or any other platform, you’re instead linking to something of value that includes the affiliate link, such as a video, an epic post on your blog, or a link to sign up for a webinar.

You’re not linking directly through your affiliate link, but a resource that will engage people beforehand, earn their trust, and show them what the product is about before clicking on your affiliate link.

Yes, one of the cardinal rules of online marketing has long been that the fewer gateways or clicks people have to go through before they get to the “buy” button, the better.

But I think that’s been changing, and now it’s closer to the less information you give away, the less you’re likely to make a sale.

The more trust you can earn beforehand, the greater the likelihood people will buy from you.

You don’t want someone to have to click 100 times before they get to where you want them to go, but a few clicks is okay, as long as you give them enough information beforehand to help them make their decision.

7. Run A Giveaway To Take Advantage Of “Social Proof”

Social proof is the idea that people will naturally gravitate toward what the masses are doing. As an example, say you’re at the mall, and you see a huge crowd gathering around one store.

You can’t help but want to know what’s going on—everyone else is there for some reason, and you want to know what that reason is.

Online, this translates to having other people do the marketing for you, except in this case it’s through metrics like numbers of subscribers, likes, comments, and things like that.

Here’s how this strategy can play out in the real world.

When you plan to promote a product as an affiliate, try to work with the owner to get a few copies to give away to your audience for free.

Maybe you can get a discounted price for a limited time only for your audience as well. This may not always be possible, but it never hurts to ask.

In a blog post, review this product—maybe it’s your epic post, or maybe you just mention it at the end of one of your regular posts.

Share that you have two or three copies of the product to give away for free, and that in order to be entered to win one of the copies, your audience members have to leave one comment about how they would use the product and why it would help them.

Have them go through an affiliate link of yours to see what the product is all about first, and then come back to your blog to leave their entry as a comment.

What happens here is that you get tons of people leaving comments that become social proof for the greatness of the product.

There’s nothing more powerful than someone else’s recommendation, and in this case, it’s other people’s recommendation for a product you’re promoting as an affiliate.

Plus, you can follow up with the people who leave a comment on the post but don’t win, to share a limited-time deal or an email saying thanks for the entry and giving them your affiliate link one more time.

I’ve used this strategy to great success promoting several products in the past, so I suggest you give it a shot.

8. Promote Products Indirectly Via Your Email List

Your email list is an integral part of any affiliate marketing campaign—and if you don’t have one, you need to get started building one yesterday! Email is extremely powerful for marketing, which is why so many people say, “The money’s in the list.”

As with social media, I recommend indirectly promoting to your email list. I don’t directly promote anything on my email list. If there are any links in my emails they point back to other content, usually on my blog, such as epic posts, videos, webinars, and the like.

Email should be all about giving people as much high-value content as possible, not direct selling. In fact, certain affiliate programs such as Amazon’s don’t even allow you to include affiliate links in emails. For more on Amazon, check out my Amazon affiliate marketing guide here.

You need to take great care of your email list and not be too aggressive with it. Indirect promotion is a much better way to go about things, especially if you’re focused on building trust with your audience (and you should be!).

9. Promote Products Indirectly On Other People’s Sites

This is another instance in which indirect linking is your friend.

If you’re interviewed for another person’s blog, or asked to write a guest post, you can link back to a piece of content on your site that contains your affiliate link.

As with social media and email, you don’t want to hit people over the head with your links—and most of the time, if you try to link directly to an affiliate product through someone else’s site, they won’t allow it anyway.

10. Review And Compare Different Products Of The Same Type

Another strategy is to compare different products of the same type. Compare and contrast, and if you give them your recommendation, make sure that link is an affiliate link.

The reason this works is because people like to shop around, but they also like convenience. So instead of making them carry out their search all over the web, keep them on your site by reviewing each of the different products in one spot.

If you’ve done a good job building up audience trust, then a well-written comparison review of different products of the same type can be a great way to drive affiliate purchases.

This could potentially become an epic post as well, complete with videos and special deals just for your audience.

How to Start: Affiliate Marketing for Beginners

Many how to start affiliate marketing posts suggest a series of steps similar to this:

- Find a company and product you want to promote.

- Sign up as an affiliate.

- Get your unique affiliate link and add it to your site.

- A visitor to your website clicks the link, which takes them to a third-party page.

- If the visitor makes a purchase, you receive a commission based on the value of the item purchased.

Now, these steps are definitely accurate—you can’t earn money with affiliate marketing without first finding a product to promote!

But more importantly, you shouldn’t be affiliate marketing without first establishing trust with your audience. Audience first, always.

That’s why my methodology for successful online affiliate marketing goes like this:

- First, build a relationship with your audience.

- Then, identify a product that might fit your audience’s needs.

- Next, use and test the product yourself, to ensure it’s truly something worth recommending to your audience, so you don’t risk taking advantage of their trust.

- Show your audience tangible proof that the product does what it promises via a blog post or case study on your website or YouTube channel.

- Then—and only then!—you can start to promote the product to your audience and hopefully start earning some affiliate revenue when they purchase it.

This approach puts your audience’s needs front and center, setting you up for success with affiliate marketing.

This YouTube video featured a panel discussion between me and several online course creators, hosted by Teachable, an online course creation platform for which I’m an affiliate.

Although I shared my Teachable affiliate link in the show notes, the primary purpose of the video was to deliver value to my audience, not promote the link.

Put Your Audience First (Build Trust)

Affiliate marketing helps me generate over $60,000 in affiliate commissions each month. My affiliate income has grown because I follow two major rules:

- I only recommend products that I’m very familiar with. Preferably, these are products I’ve used before and that have helped me achieve something. If I’m not confident in the product and I don’t feel it will help people, I will not promote it.

- I never directly tell anyone to buy a product. I always recommend products based on my experience and in the context of what I’ve done or what I’m doing with it.

What does following these two rules achieve?

Trust.

By doing these two things, my audience knows that I only want them to buy the tools that they need, at the time they need them. They know that I’ve used and believe in the products I recommend.

And they know there’s no pressure, because I’m only looking out for their best interests.

Many affiliate marketers choose not to follow these rules—and I think that’s why affiliate marketing has a bad reputation. We can do better, and so I hope you’ll join me in following these rules.

Every affiliate marketer needs to understand the importance of establishing and maintaining trust with their audience before they get started with affiliate marketing.

Thankfully, my system for getting started has trust baked into the entire process. Let’s dive into it now!

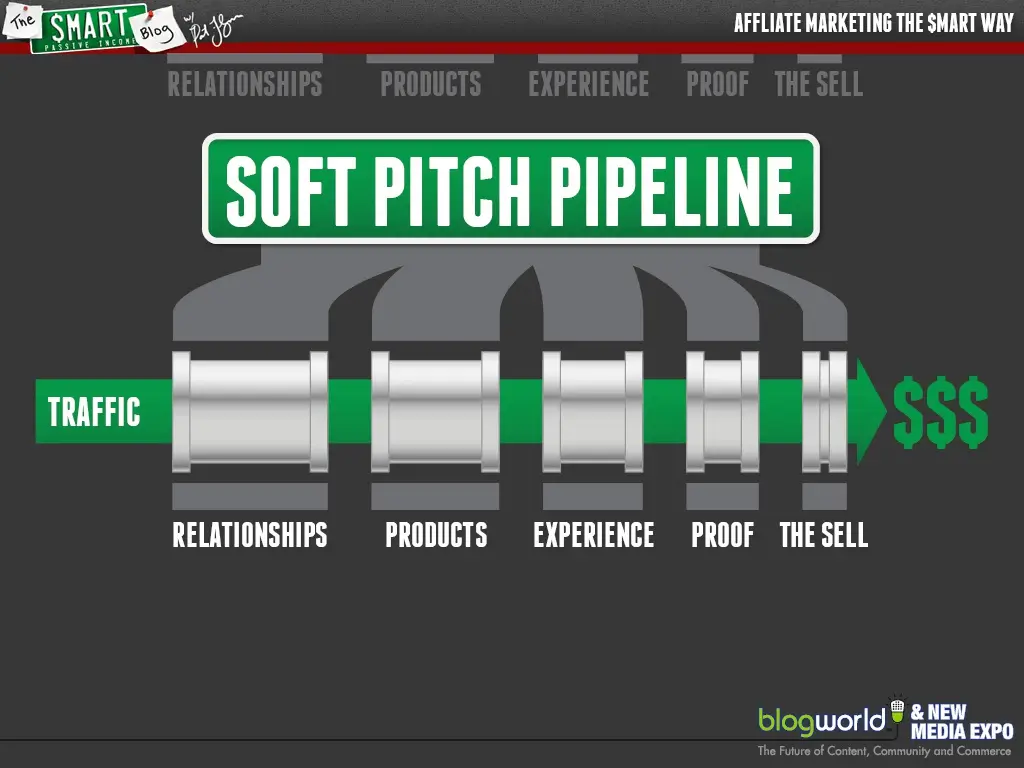

The Soft Pitch Pipeline

My approach to affiliate marketing is built around something I call the soft pitch pipeline.

This approach is designed to do two main things: build trust, and reduce the amount of “hard selling” needed to promote your affiliate products (hence the “soft pitch” part).

Imagine a series of pipes. These pipes represent the experience or “flow” people go through when they visit your site or are introduced to you and your brand.

On one end is traffic entering the pipeline, and on the other “exit” end of the pipeline is the sale or conversion.

Between these two points, there are five segments that combine to make up the total experience of your brand:

- The Relationships you cultivate with your audience

- The Products you decide to promote

- The Experience you have with those products

- The Proof you share that those products work

- The Pitch or “sell” of those products to your audience

These segments can vary in strength and size.

For example, if you have an amazing relationship with someone, it doesn’t take much to convince that person to do something for you.

In this case, the relationship segment is extremely long, so the pitch segment doesn’t have to be long at all.

For example, say your wife is pregnant. It’s two in the morning and she wants you to go to the store and buy a Little Debbie’s Fudge Brownie. Well, you’re probably off to the store to buy a Little Debbie’s Fudge Brownie—there’s not much pitch or convincing needed at all.

Now take the other extreme: a company you’ve never heard of before.

Since you hardly have any relationship with this company, they’re going to have to work a lot harder to pitch you—to convince you to try them out.

And many companies pitch really aggressively, which can backfire and make people uncomfortable or even annoyed.

That’s exactly what we try to avoid with the soft pitch pipeline.

By focusing on the first four segments of the pipeline—the relationships you cultivate with your audience, the products you promote, the experience you have with those products, and the proof you can share with your audience that the products work—you can make the pitch phase shorter and less aggressive.

If you set up the first four segments of the pipeline the right way, hardly any pitch will be needed to get your audience to click through your affiliate links and make a purchase.

Let’s go over each of those segments now!

Segment 1: Relationships

Relationships are everything.

Having a relationship with your audience is the foundation of trust. It also allows you to get to know your audience in depth, so you can understand their needs and pain points.

That way, you can identify potential products that can help meet those needs and pain points.

Not too long ago, a lot of people were trying to do affiliate marketing by finding a product that offered an attractive commission, then building a site around it and selling it by driving traffic using Facebook ads and Google Adwords.

That tactic used to work, but Google and Facebook have caught on and started clamping down on those ads, making it much harder to pull off.

But more importantly, on a strategic level, it’s just not the right way to do things if you’re interested in building a lasting business. Instead, you need to take a longer-term approach, one centered around relationship building.

What does that look like?

First, you need to identify a target audience that has a specific pain, issue, problem, or goal.

By homing in on that target market and understanding exactly what they’re going through, you can discover ways to help them achieve their goals and overcome their problems.

The key is to not go into it with the aim of finding an affiliate product, but to get to know your audience and find solutions they can use.

Start with the pain, not the product.

How do you learn what your audience needs?

You need to become friends with the people who visit your site and interact with you on social media. Without that relationship, it’s much less likely that meaningful transactions will ever occur.

By meaningful transactions, I’m not just talking sales transactions—I’m talking about email list subscriptions, comments, clicks, likes, follows, shares, and retweets.

The hard part is, a relationship takes time to build.

Thankfully, there are ways to speed up the process of building a relationship with your audience without compromising the quality of that relationship.

So how can you connect with your audience more quickly? Here are three ways:

1. Be Personable

What would make YOU buy something from someone you didn’t know, especially if they were selling a product they didn’t even make themselves?

In a lot of my content, be it blog posts, podcast episodes, and even in-person presentations at large conferences, I try to share aspects of my personality and my personal life.

As a result, most of my audience knows a lot about me—that I’m a family man, that I love Back to the Future, that I’m still working toward my goal to touch a regulation-height basketball rim…

The point is, they know me as a real person, someone just like them.

They can relate to me. And as a result, they’re much more connected to me than if I were to spend all my time telling them about the strategies and tactics that will help them build a successful online business.

What do my kids or my favorite movies have to do with affiliate marketing? Nothing, at least directly.

But what do those things have to do with my brand? Everything, because building a brand is the equivalent of building relationships.

People connect with people, and the more you can become a person in the eyes of your audience, the easier it is for them to connect with you—it’s as simple as that.

2. Tell Stories

People are programmed to love stories.

Think about the last time you were engrossed by someone’s tale around the dinner table, or just watched a movie or read a book.

When you tell a story, it’s easy for your audience to put themselves into that story; stories put things in context and make them relatable. Stories are an easy and personable way to relate to your audience.

Now, you don’t have to dedicate entire posts to stories about random things to create a meaningful connection.

Instead, be creative and share little anecdotes and examples here and there to illustrate concepts, honest stories that relate to the message you’re trying to get across.

Doing this helps you convey information and build those important relationships with your audience at the same time.

3. Practice ROAK

RAOK is short for “random acts of kindness,” and it’s one of my all-time favorite things to do.

Why?

Because when you do something unexpected and generous for someone, it leaves an amazing impression.

It can be as simple as replying to comments on your blog and social media. I do this, and it helps people see I’m a real person.

If someone has a question, I answer it. It saves them time, and helps them remember who I am.

Sometimes I even take it a step further and leave comments on the blogs of people who’ve left comments on my posts.

It’s small things like these that can help you quickly form a deeper relationship with your audience.

And you can do the same thing!

So ask yourself, what kinds of RAOK can I do for my audience? What unexpected favors can I perform that will help me build a positive, lasting relationship with them?

Segment 2: Products

Once you’ve started to build your audience and develop a relationship with them, you’ll start to learn what that audience needs.

The next step is to identify products you can recommend to meet your audience’s needs and help them in their journey.

First, keep in mind that sometimes the products will be ones that allow you to generate an affiliate income—and sometimes they won’t.

You never want to start with a product or commission in mind. You want to start with the problem, then find solutions for it.

And if the best solution for a particular problem is not an affiliate product, well, that’s what you should promote to your audience. Remember, trust and relationships come first, always.

With that in mind, once you’ve gotten to know your audience and its needs and pain points, how do you select a specific product?

To help you get in the right frame of mind here, think about a brand new visitor who comes to your site for the first time—what is it you want that person to ultimately achieve?

This might be a tough question to answer, but you need to know what you want your visitors to do, because if you don’t, then everything you recommend is going to seem random.

You need your recommendations to be precise and targeted, so your audience can get what they need from you to reach their goals.

Once you’ve identified what you want to help your new visitor to achieve, think about how they’re going to get there.

What’s their roadmap or path to success? Defining the steps on this path will help you determine exactly what kinds of products will help your audience at different points along the path.

Next, you need to think about the products that will help your audience along this path.

One of the best places to start identifying these products is through ones you’ve used yourself. Whatever niche you’re in, spend a little time making a list of the tools and services you use.

Those things that you used to help you achieve your goals can help your audience achieve their goals too. Just about any product or service can work, including:

- Courses

- Books

- Physical products

- Software

- Coaching services

Often, you’ll need to look beyond the products and services you already know and use to find things that will be a good fit for your audience—which means doing some research!

Thankfully, there are plenty of great places and resources to find new affiliate products, including:

- Word of mouth—your professional network, including masterminds, Facebook groups, etc.

- Amazon, to find books and products

Remember: don’t start with the products; start with your audience’s goals and pain points. Then find the products to help them get where they want to be.

It’s also important to realize that by not promoting products and services that will help your audience along their “success path,” you’ll actually be holding them back.

Remember, your knowledge and your relationship with your audience can help them filter through all the noise and find the right solutions, because you’ve put in the work to understand what’s best for them.

Finally, it should go without saying, but if a product doesn’t make sense to promote—if it’s not a part of the audience’s success path—then you shouldn’t promote it, no matter how generous the affiliate commissions may be.

Segment 3: Experience

Okay. You’ve found a product that will help your audience achieve their goals. Now what? Do you immediately start promoting it to them with your affiliate link?

Not yet. The next important element in decreasing how much you need to pitch is the experience YOU have with those products.

I have two words for you: Experience sells.

On Amazon, we read other people’s reviews—people we’ve never met!—to help us make a purchase decision.

That’s powerful stuff, so imagine how much more powerful your real-life experience with a particular product can be, combined with the relationship you have with someone in your audience already.

So, before you start promoting your product to your audience, you need to get to know it yourself, inside and out.

Affiliate marketing works best when you treat the products you’re promoting as your own. You need to know firsthand the experience your audience will have using this product.

Obviously, if you learn that the product is a dud, it’s not going to make sense to promote it to your audience!

And if it’s great, then you’ll be reassured that your audience is going to find it useful.

As a result, I really encourage you to use and test a product thoroughly before you promote it, for three main reasons:

1. For Your Protection

You have to understand what it’s like to use any product you promote, because your audience’s trust is the most important thing in the world.

Anything you promote directly reflects on you and your brand, whether it’s your product or somebody else’s. If you’re promoting it, your reputation is on the line.

2. To Become a Resource

By using and experiencing a product, you’ll be able to answer specific questions about it much better, and become a helpful resource for an interested person in your audience who could become a buyer.

3. (Most Importantly) To Get Rid of the Mystery

By showing your audience exactly how a product is used, they’ll be able to imagine themselves using it.

You make that product a known quantity, and make it easier for your audience to imagine buying it and benefiting from it.

So, how exactly do you show your audience how a product is used?

The key is to show the product in action—to show yourself physically using it.

Why is this important?

Science, and little things in our brains called mirror neurons.

Mirror neurons are a special set of brain cells that respond when we see other people do stuff; they let us understand what it feels like to do something by watching other people do it.

As an example, take all the “unboxing videos” on YouTube—the ones where someone buys something like an iPad and records themselves unwrapping the plastic and taking out all the parts and firing it up—those videos are extremely popular!

Check out this example, where I unbox three podcasting mic options for under $75:

People like to see exactly what they’re going to buy, so do yourself and your audience a favor and “unbox” the products you’re promoting as an affiliate.

Write extensive blog posts about products and everything there is to know about them. Record videos and podcast sessions with the products’ owners with questions to popular questions about the product.

You can even host live webinars with real questions from the audience about the product.

So, show them what it looks like, how to use it, and how not to use it. Share the good, the bad, the tips, the tricks, everything. Make it easy for them to picture themselves using it.

In every case, be honest and thorough. Give your audience enough accurate information to make a qualified decision about whether the product will work for them.

Segment 4: Proof

Next in the pipeline is proof.

People want to see how a product can help them be successful at achieving their goals. I’m talking about real, tangible proof—undeniable results you can feel, taste, smell, and touch.

You can’t just say something will help your audience—you have to show them.

Proof is similar to experience, but it’s about focusing on the positive outcomes of using a product. If experience is about seeing the product in action, proof is about seeing it work.

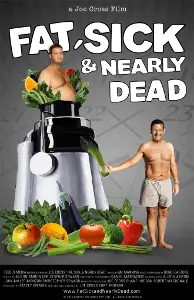

A few years ago, I watched a documentary called Fat, Sick & Nearly Dead. It’s about a man named Joe Cross who was going through a tough time: he was really overweight and had a lot of skin problems, things he attributed to the food he was eating.

The documentary covered his ninety-day juicing journey. That’s right—all he consumed for ninety days straight was juice.

His transformation was remarkable, and you saw it happen over the course of the documentary. By the end of the ninety days, he was completely healthy—off his medication, no more skin rashes, happy and healthy and thin.

Only thirty minutes after watching that documentary, I had a receipt from Amazon in my inbox for my new Breville Juicer.

All thanks to Joe Cross, whose documentary showed his remarkable transformation in a bold, personal way.

This documentary is almost the perfect example of proof—showing your audience the remarkable outcomes that are possible for them.

After watching Fat, Sick & Nearly Dead, I didn’t need to hear a pitch. The proof of Joe Cross’s transformation did it all for me.

If there had been an affiliate link mentioned at the end of that documentary, I would have been more than happy to use it. I was on the fence initially, but showing that proof sealed the deal and moved me firmly into the “buyer” camp.

If you can show the success you’ve had with a product, your audience will be excited about the possibility of achieving the same success.

Joe’s platform for showing his proof was a documentary—maybe yours is your blog, or a podcast you’re starting, or video, or all of the above.

Whatever it is, give your audience tangible proof—data and demonstration—that the products you’re promoting can change their lives for the better.

Segment 5: Pitch

The last part of the pipeline, before you get to a conversion or sale, is the actual pitch or sell.

There’s a reason this comes last—because, as I mention throughout this guide, trust is key. You shouldn’t start directly promoting a product until you’ve earned your audience’s trust and know the product is something they will benefit from.

Here’s the great part: If you’ve done things correctly to this point, the pitch phase should be the shortest and least aggressive part of the pipeline.

The more you focus on building a relationship with your audience, recommending products that align with their success path, sharing your experience using that product, and providing tangible proof of that product’s benefits, the less important it becomes to actually pitch the product directly.

So yes, you can reduce the amount of pitching you have to do by focusing on the first four stages of the pipeline.

But at a minimum, you’ll still need to enable the sale. You need to make sure people have a way to click on your affiliate link to buy the product!

This means creating a point of sale where you insert one or more calls to action (CTAs) to click on the affiliate link and purchase the product. You have lots of options in terms of where to put these links and CTAs:

- Emails

- Blog posts

- Landing pages

- Podcast show notes

- Webinars

- Social media messages

So is it as simple as just adding your link to an email or blog post and watching the commissions roll in?

Not so fast!

There are a few crucial tips to keep in mind when it comes to adding your affiliate links at the point of sale.

1. Be Honest

When you provide a link, always be clear that it’s an affiliate link that will earn you a commission for each sale.

In fact, if you do everything in the pipeline leading up to this point, this will actually help you, because people will want to pay you back for everything you’re doing for them.

Some people may not know about affiliate links and commissions, and will sometimes open a new window to buy a product.

By being honest and upfront that you’re using affiliate links, you’ll help ensure you’re getting all the affiliate commissions you deserve.

2. Offer Support

In addition to telling them it’s an affiliate link, offer to answer questions and provide support if needed.

This is a great way to show your audience, right at the point of sale, that there’s someone there to help them if they need it.

Yes, this also means someone to blame if things don’t go well—but since you’ve already vetted the product and learned how to use it, you shouldn’t have any problem taking on that responsibility.

3. Provide Multiple Opportunities

Give people more than one chance to click through your affiliate link.

Take blog posts, for instance, since they’re probably the most popular way to share affiliate links. A lot of times, business owners will just link the first mention of an affiliate product in a post.

If their reader misses it—or keeps scrolling, intends to return, then forgets to scroll back up—well, you’ve lost your potential commission.

Instead, add a link near the beginning, middle and end of a post.

Also remember that, beyond just blog posts, there are lots of ways and places to share your affiliate links, including:

- YouTube videos

- Emails

- Podcasts

- A “resources” or “tools” page—in fact, my tools page here on smartpassiveincome.com is my most profitable page.

4. Offer a Bonus

Offering a bonus with an affiliate product is a great way to make sure your audience goes through your link and not someone else’s.

Lots of people use the bonus technique, but many don’t use it to its greatest potential.

They’ll throw in random things that aren’t something the potential buyer needs. If you really want to knock bonuses out of the park, create a bonus that truly complements the product you’re promoting.

This could be something like:

- A quick-start PDF guide on how to use the product

- Access to something you have that complements the product—if you’re selling a juicer, you can provide a recipe guide to go along with it

- A coupon code or discount on a related product or service

Get creative!

5. Remember Why

Finally, remember why you got into affiliate marketing.

It’s not for the commissions. It’s for your audience—to help them achieve something.

It’s your responsibility, as someone with a platform and an audience that trusts you, to give them the products they need to achieve success.

Your commissions are ultimately a byproduct of how helpful you are to your audience. So aim to be incredibly helpful, and you will earn more in the long run.

When you approach affiliate marketing in a way that keeps people around and doesn’t rely on the pitch, but rather everything that happens before that—the relationship, the product, the experience, and the proof—you’ll set yourself up for maximum success.

Remember: Use affiliate marketing as a tool to help your audience, and the commissions will come!

Affiliate Marketing Examples

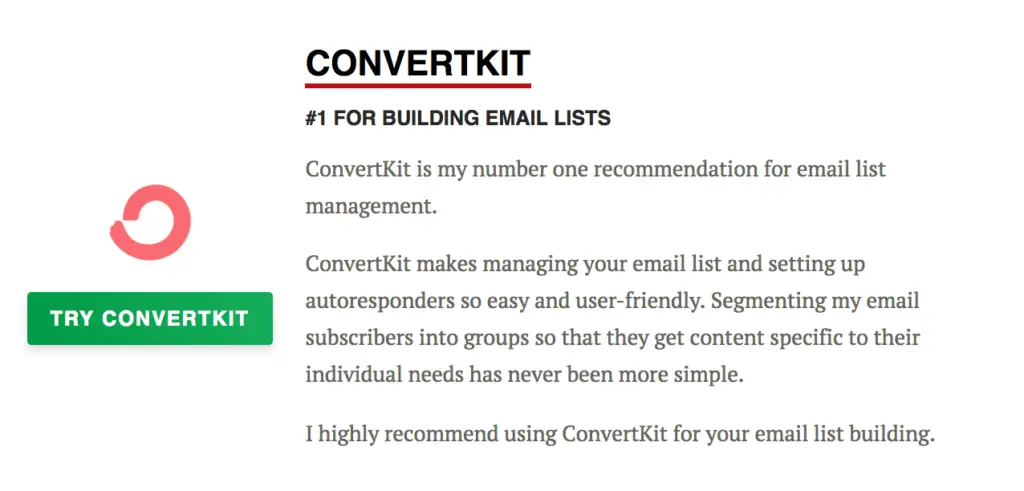

What does affiliate marketing look like? If you’ve visited my website, you may have come across my Tools page.

This page contains a list of recommended resources—products, services, apps, and more—to help my audience build their own online businesses.

Many of the links on this page are affiliate links, meaning I receive a commission if someone clicks on the link and purchases the product or service it links to.

Here’s what someone sees if they click on my affiliate link for Bluehost, the web hosting company I use and recommend:

And here’s what they’ll see when they click on my affiliate link for ConvertKit, the email service provider I’m happy to recommend:

As we’ll further discuss below, you can also earn affiliate commissions by signing up with an affiliate network. One of the most popular is the Amazon Associates program which you can read more about here.

You can easily find tons of other examples of affiliate marketing “in the wild.”

For example, Create a Pro Website is an affiliate marketing website and YouTube channel that creates tutorials on anything and everything related to “how to create a website.”

They do a good job of offering value through demoing products (which we’ll see in the case study below is a great affiliate marketing strategy), while working in their affiliate links where it makes sense.

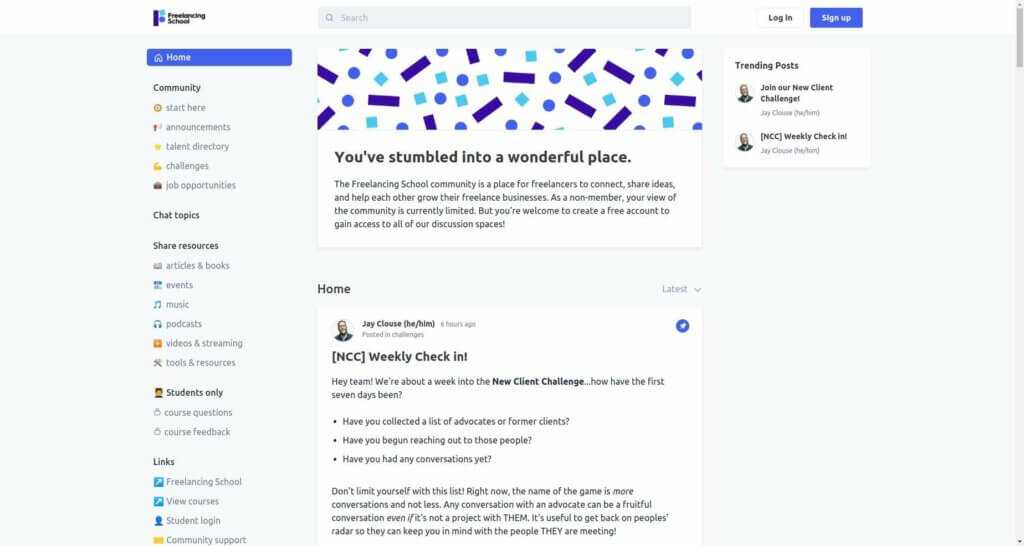

Freelancing.school is a particularly good example of focusing on building relationships with an audience first by offering extras like a community of like-minded individuals and a free course to help people find success with their freelancing careers.

These days, even well-established news outlets like the New York Times are becoming affiliate marketing websites!

The example here is NYT’s Wirecutter section, which reviews products and offers tutorials on everything from How to Clean a Toilet the Right Way to Everything You Need to Make Hot Pot at Home.

Affiliate marketing is essentially about sharing your affiliate links, so however you choose to share those links—whether on your website, on social media like Twitter, Facebook, or YouTube, or via emails to your list—well, that’s affiliate marketing in action!

Affiliate Marketing Case Study: SPI + ConvertKit

Next up, I’m going to share a case study to show you what effective affiliate marketing looks like “on the ground.”

This case study is based on a product I’ve recommended for a long time that’s also become one of my biggest drivers of affiliate income.

From 2015 to 2017, it brought in a whopping $315,000 in affiliate revenue.

ConvertKit is an example of a product I promote as part of a long-term strategy.

It’s a great example of an affiliate resource I promote to my audience that can benefit and serve them over the long term and hopefully I earn a healthy affiliate income at the same time.

Although I love and use ConvertKit myself (and the founder, Nathan Barry, is a good friend of mine), the point of this section is not to promote the product.

Instead, I’m here to show you how I’ve promoted ConvertKit.

And I’ve done so in a very specific way: by D-O-I-N-G. This strategy has helped me be very successful in promoting ConvertKit as an affiliate.

Those letters stand for:

- Demo the product

- Offer answers to your audience about the product

- Interview the founder of the product

- Never recommend more than one of the same kind of product

- Get the product in front of your people

Before we get into the details of the D-O-I-N-G approach, here’s a little background on how I got started promoting ConvertKit as an affiliate.

ConvertKit wasn’t my first email service provider.

My first one, back in 2010, was AWeber.

AWeber was great as an entry-level email tool, and I also promoted it as an affiliate, making up to $2,000 a month at one point.

And that income still comes in each month, because I get paid a recurring commission for every month a person I refer stays on, even though I’m not actively promoting the product anymore.

Eventually, though, I needed an email service that was easier to use with more advanced features.

For a while, I turned to another tool called InfusionSoft, which was good, but still not exactly what I needed.

Shortly after I started using InfusionSoft, a friend of mine, Nathan Barry, reached out to me to ask how I was doing with the new tool.

Nathan had recently started a new email service provider, ConvertKit.

We met for coffee in downtown San Diego a couple weeks later.

After catching up about personal stuff, the conversation turned to business.

Nathan asked me a lot of questions about my needs, experiences, and desires as a blogger, podcaster, and digital marketer.

He didn’t try too hard to plug his new tool, except toward the end of our conversation when he said, “Hey, if Infusionsoft doesn’t work out for you, let me know, and we can see how you might be able to use ConvertKit.”

I didn’t think much of his offer for a little while.

But over time, I started growing more and more frustrated with Infusionsoft.

So I reached back out to Nathan to see how ConvertKit was doing.

I wasn’t surprised to hear that they were experiencing constant growth month after month.

New features were being added on a regular basis, and after a couple of side conversations with other users, I was happy to hear extremely positive reviews.

That’s when I asked Nathan to demo the current software for me over Skype—and I was blown away.

I loved the intuitive user interface, along with the tool’s segmentation and automation capabilities.

Seeing what the tool could do, it wasn’t long before I decided to switch from InfusionSoft, and Nathan’s team even helped me migrate my email list.

I’ve been using ConvertKit very happily ever since.

That positive experience has shown up in terms of my affiliate revenue from ConvertKit too.

Although I was happy with my AWeber affiliate income, since shifting to ConvertKit, I’ve broken into a new level of affiliate income and success.

Part of that is because ConvertKit is an amazing tool—but a lot of it has to do with how I leveled up my promotional efforts with the D-O-I-N-G approach.

Let’s learn all about it now!

D: Demo The Product

Affiliate marketing is technically easy to do.

All you have to do is get your affiliate link and start sharing it with your audience. It’s easy to stop there and think you’ve done enough.

But if you’ve been with us since the beginning of this post, you know that a crucial practice in affiliate marketing is to take products that are not your own and treat them as if they were your own.

If you were selling your own product, you’d show people what they were going to get before they got it, right?

But most people who do affiliate marketing just share a link and a couple of sentences and call it good.

Instead, as we talked about above, you need to show the product in action. That’s where the demo comes in.

People are more likely to buy when they know what they’re getting and exactly how it will help them.

The best way to do this is with a video demo that shows people two main things: 1) how they can benefit from the tool and 2) how to use it.

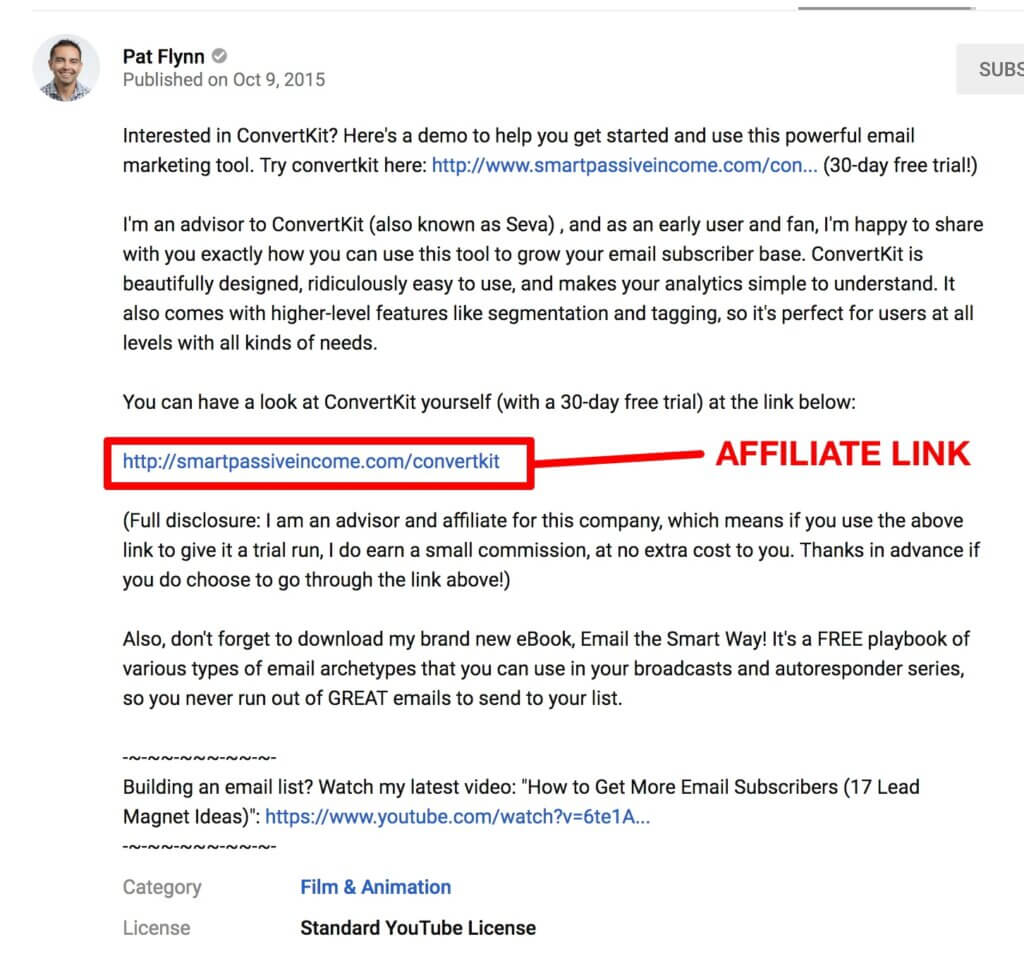

In 2015, I created a YouTube demo of ConvertKit.

In the video, I talk about the benefits and features that made me fall in love with ConvertKit: ease of use and setup, beautiful design, powerful statistical analysis, segmentation and tagging, and a lot more.

Along the way, I show screenshots of ConvertKit in action, so viewers can see exactly how to accomplish different things using the tool.

When you search “ConvertKit demo” or “ConvertKit tutorial” on Youtube or Google, my demo is typically one of the top results.

It’s been viewed 30,000+ times, and it’s driven a ton of traffic both back to my website and through the affiliate link mentioned in the video description.

When you’re thinking about creating your own demos, you want to show not just the features and benefits of the tool, but also make it fun and show your personality.

In the ConvertKit demo video, although you don’t get to see much of me (it’s just my voice with a Screenflow video), I’m just being myself.

I could have made a stiff, mechanical demo that was all about just conveying the relevant information—and it would have been shorter too—but who wants to sit through that?

Instead, I’m relaxed and sharing my honest opinions, using words like “cool” and “powerful” (and yes, “nice”!) to convey my excitement about ConvertKit’s capabilities, in the hopes that excitement will be shared by my audience too.

You want to create a thoughtful demo that shows you care about creating informative content while also keeping your audience engaged and excited to try the tool.

And of course, make sure you include calls to action (CTAs) to go through your affiliate link, as well as disclosing your affiliate relationship with the company.

You don’t want to bombard your audience with these CTAs, though, and if you’ve provided enough valuable, engaging content in the demo, you shouldn’t have to include more than one or two CTAs.

In my ConvertKit demo video, I only mention my affiliate link and status twice very briefly, at the very end:

“Go ahead and check it out: smartpassiveincome.com/convertkit. And I look forward to seeing how you are able to use it. Like I said, ConvertKit’s coming out with a lot of other stuff in the future too, to make our lives even easier. Hopefully this is helpful. Cheers. I appreciate you. That affiliate link one more time, which I do get a commission from if you do go through that link, is smartpassiveincome.com/convertkit. Thank you so much, and I’ll see you in the next video.” [Full Disclosure: I’m a compensated advisor and affiliate for ConvertKit.]

In other types of content, such as blog posts, I might share my affiliate link a little more often, for instance at the beginning, middle, and end of a post.

But in either instance—whether a video demo or a blog post—the content itself does the “heavy lifting” of sparking someone’s interest in trying out the product, so I don’t have to hit my audience over the head with my affiliate link.

O: Offer Answers

The next step is to offer answers to people’s questions.

This is huge, because if a person asks you a question about a product, they’re likely already interested in it.

They may just be on the fence, and if you can be the one to answer their questions, that may give them the final piece of the puzzle to go ahead and make a purchase, knowing there’s someone there to provide product support if they need it.

That’s why I always offer support for ConvertKit and the other affiliate products I promote.

When questions come in, I’m quick to answer them because I want to make people feel comfortable with the idea of spending money on this thing I’m promoting.

The combination of the demo and offering answers is powerful.

If you put together a thorough and helpful demo, you’ll likely answer a lot of people’s questions in the demo itself.

But even if your demo covers all the bases you can think of, you should still offer to answer people’s questions.

Why?

Even if they don’t have any, just the fact that you’re offering this assistance will make people feel more comfortable and inclined to buy the product through your link. Remember, you want people to trust you and feel secure in their investment.

Want an example of how you could offer support in this way? Here’s what I say toward the end of the ConvertKit demo video I mentioned in the previous section:

“I’m here to answer your questions too. If you’re watching this on YouTube, ask your question below; I’ll do my best to answer it. If you’re watching this on the SPI blog, go ahead and leave your question in the comments section. Or, if you want to send me an email, that’s totally fine too. Happy to help, because I really believe in this product.”

I also offer to answer people’s questions about my affiliate products via other channels, including email and social media.

People often reach out to me on Twitter, because Twitter makes it easy for me to reply quickly.

It helps that there’s a character limit, too, because it forces both parties to get to the point.

Offering to answer questions also makes people feel secure about the fact that if they were to have questions later on, once they’re up and running with the product, you’ll be able to answer them.

This is especially important if the product you’re promoting is of a highly technical nature.

So, offer support and people will be more at ease about buying through your affiliate link.

I: Interview

When you’re promoting an affiliate product, having other people talk about the product, and the story behind it, can be a powerful way to get people excited about it.

A great way to do this is to start a podcast and interview the founder of the product on one of your episodes.

ConvertKit founder Nathan Barry joined me on episode 244 of the Smart Passive Income podcast, titled “Bootstrapping a Business.”

But here’s the thing: we didn’t actually talk about the product itself much at all!

We talked about his story, and how he bootstrapped the company and grew it successfully.

We talked about how I met him and built a relationship with him and his company, eventually becoming an advisor to ConvertKit.

Because the product itself—as well as my affiliate relationship with ConvertKit—was not the focus of the interview, listeners were able to focus on how much care and quality Nathan put into creating the product and cultivating the company’s culture.

As a result, in a way, they were able to start building a relationship with him too.

I only mentioned my affiliate link at the very end in a casual way, as almost a natural conclusion to the episode.

The ability to augment your affiliate marketing efforts by interviewing the founder of a product you’re promoting is a great reason—among many—to have a podcast.

Even though Nathan and I recorded the episode in 2016, people are still downloading and listening to it today.

I also reference the episode a lot when I mention ConvertKit, which helps make it an active resource in promoting my affiliate relationship.

So, if you’re planning to promote a new affiliate product, see if you can get the founder of that product on your podcast.

If you can’t get access to the founder for a podcast interview, consider an email interview or maybe a video interview over Skype or Zoom.

And if you can’t get the founder, try for somebody who represents that company at a high level.

If that’s not possible either, aim for somebody who’s used the product and knows it well, hopefully somebody your audience is already aware of and respects.

In the How to Start Affiliate Marketing above, we talked about the importance of promoting a product yourself, showing how much you know and love it and the great results you’ve gotten from using it—i.e., showing proof.

When you’re the only one doing the showing, there’s always the risk, however small, that your efforts may come off as too promotional.

On the other hand, as the Nathan Barry podcast episode showed, interviews are powerful because most of the selling that’s done is indirect—and often, you won’t have to talk about the product much at all.

N: Never Recommend More Than One Of The Same Kind Of Product

Next up, you should never recommend more than one solution for a specific type of problem.

This is a really important rule, and one that generates a lot of debate.

And there are exceptions, which we’ll talk about in a second.

But first, what exactly do I mean by never recommending more than one of the same kind of product?

Well, if I were to recommend ConvertKit, but also recommend other email solutions like AWeber or MailChimp, it would dilute the strength of my primary recommendation.

You need to pick one, because otherwise people are going to be confused.

I went the route of recommending multiple similar products once, and it didn’t go well.

People said, “Wait, I thought you were recommending this one. But now you’re talking about this one? What’s the difference? How is it better?”

You don’t want people asking themselves even more questions about which product makes sense for them.

That’s why they came to you in the first place!

So, yes, I’ve made my decision, and the only email service provider I recommend to people is ConvertKit.

Are you recommending more than one product right now that’s essentially the same type of solution?

If so, you’re diluting your affiliate marketing efforts and reducing the amount of income you can make. Yes, sometimes it’s great to give people options, but it can also work against you.

Now, if someone were to say, “Hey, Pat. I know you recommend ConvertKit, but what other solutions are out there?” then of course I’m going to be honest with them and tell them what other options they have.

I’m not going to say, “Sorry, Dave. There are no other great options out there.”

That would be lying. There are other great email service providers out there.

But the one I use, recommend, and trust will be there to help my audience is ConvertKit.

Plus, as with everything, there are exceptions to the rule.

In this case, only having one recommendation doesn’t make sense for some types of sites.

For example, if you run a vacuum review site, you can’t get away with promoting just one product, as that would go against the entire aim of the site.

You can certainly highlight featured products and recommendations in different categories. But when people are searching for helpful comparisons of similar products, the N rule likely won’t apply.

Here’s another example from one of my own affiliate promotional materials that you might remember from above.

In one of my YouTube videos, I review three different podcasting microphones.

Here’s the key: Even though each of these products is very similar (they’re all microphones), I use the review as an opportunity to differentiate them according to their best uses, then make specific recommendations about which microphone should be used for different scenarios.

For instance, in the video, I end up recommending that you not use one of the microphones for podcasting at all—instead, I recommend another use case that makes more sense for this particular microphone. I’m comfortable including my affiliate link to each of the microphones because I’ve made the effort of differentiating them for my audience.

G: Get The Product In Front Of Your People

This final one is a big one, and it represents a mindset shift I’ve undergone over the past few years.

Often, people become timid when it comes time to put products in front of their audience.

If that describes you, whether it’s your own product or an affiliate product, then I want you to shift your mindset—to one of excitement about sharing something you know will help your audience.

In fact, it’s your obligation and your role to do that, and you should embrace it. Because if you don’t, you’re not serving your audience in the best way possible.

It’s not about being pushy or aggressive; it’s about being motivated to get the product in front of people.

You’ve done the research, you’ve used the product, you’re offering answers, you’ve created the video demo, you’ve recorded the interviews.

You know the product can help your audience, so get it in front of them!

Talk about it on your podcast, and on other people’s podcasts.

Share it in blog posts.

Create more videos about the benefits and capabilities of the product.

That’s exactly what I’ve done and continue to do with ConvertKit.

I believe in the product, and the company, so it’s my responsibility to get it in front of my audience so they can benefit from it like I have.

I’ve used lots of methods and channels to get ConvertKit in front of my audience, including:

- Blog posts

- Videos (like the product demo)

- Social media messages

- My Resources page

- Podcast episodes (like the interview with Nathan Barry)

When it comes to getting the product in front of your audience, it pays to be creative!

On that note, I wanted to share one more pretty novel way I’ve gotten ConvertKit in front of my audience.

In a March 2018 video, I congratulated ConvertKit for a huge milestone—hitting $1 million in monthly recurring revenue (MRR).

In the video, I also shared 8 important lessons for people looking to start and grow a business, ones that came directly from ConvertKit’s example in becoming a $1 million MRR business.

The video was a response to a single tweet by ConvertKit’s founder, Nathan Barry, about the company’s $1 million milestone.

But I built on that tweet to tell a much richer story about the company and how they were able to accomplish something so remarkable. You can see the whole thing below.

The key in this video is that I didn’t focus that much on the product itself—and especially not on my affiliate relationship with them—but on ConvertKit the company, and how they used 8 powerful and ethically minded principles to grow their business rapidly.

These are principles anyone who’s trying to grow their own business the right way can learn from and implement.

And you can do the same thing I did with this video.

Ask yourself, what can I learn from the success of a company I have an affiliate relationship with?

How can I use that company’s example, and the principles behind its success, to help my audience and deliver them value?

When you do that, you’re getting the product in front of people—but you’re also giving them so much more.

8 Best Affiliate Programs and Networks

Reminder: always start your affiliate marketing journey by building a relationship with your audience and never recommend products you haven’t used or don’t love.

That being said, I want to give you a starting point for finding affiliate marketing programs that might be a great fit for you and your business, and give you some insight into what you should consider when evaluating affiliate marketing websites and opportunities.

Note: I’ve used many but not all of the below networks and programs myself, but am familiar with the others from my research and recommendations from friends and colleagues.

So while I’m comfortable sharing them with you there isn’t any direct financial benefit to me for doing so.

For more useful affiliate marketing tools check out this guide!

Top Affiliate Marketing Networks

Affiliate marketing networks are platforms you can join to get access to hundreds, sometimes thousands of affiliate marketing products and programs.

Let’s explore a few of the most popular:

Impact

Formerly Impact Radius, their Marketplace was built to offer content creators a seamless way to monetize their work and offer their audiences a lot of value through a huge list of brands looking to advertise and a suite of tracking and automation tools.

With direct access to global brands like Airbnb, Adidas, and Allstate, flexible payment processing, and robust reporting and alerts, there’s a good chance you’ll find them a great fit for your audience and business.

CJ

Formerly Commission Junction, CJ has spent the last 2 decades building relationships with brands and publishers to create an affiliate marketing platform worth exploring.

Advertisers you’ll find here include Priceline.com, Overstock.com, and J. Crew.

CJ also includes some one-click join affiliate programs to make it easy for beginner affiliate marketers to start their journey, while also offering omnichannel tracking (across browsers, devices, etc) and strategic recommendations based on business size, vertical, and region for when you’re more established.

ShareASale

ShareASale helps beginner and expert affiliate marketers alike create profitable long-term partnerships with brands their audience will love.

With 260+ affiliate programs launched every month (businesses like Etsy and Rebook are already on board), a product discovery bookmarklet for quickly generating affiliate links, and a slew of analytics and reporting tools, if you find a product worth promoting to your audience here you won’t be going astray.

ClickBank

ClickBank has done a good job of owning the information product affiliate program space, offering products like online courses and ebooks that you won’t find as readily on other affiliate marketing platforms.

A word of caution: I’ve seen a lot of shoddy products that were created with an earn-a-dollar first approach on offer so be sure to do your due diligence before recommending what you find here.

If the affiliate product checks out, though, this is an affiliate marketing network you can rely on for ease-of-use and on-time payments.

Best Affiliate Marketing Programs

What is an affiliate marketing program?

Beyond the products you can promote, affiliate programs include the commission rates, payment terms, marketing materials, and promotion rules a business with an affiliate product offers affiliate marketers like you.

Again, please do not start by seeing the financial opportunity in these programs and working backward from there to fit your business around them.

These affiliate marketing programs are great examples of what’s available to you as an affiliate marketer so use them, but only if they’re truly going to benefit the audience you’ve built a relationship with.

Amazon Associates

You know Amazon, now you know about their Amazon Associates affiliate program!

They’re the world’s largest retailer so if your business is related to any sort of physical product, you’ll find a quality option to offer here.

Worth noting, Amazon recently caused quite a stir by drastically lowering their commission rates (from 8% to 4% in many categories), which is a good example of why building relationships with your audience and eventually creating your own offerings is so important.

That being said, on top of having the world’s largest catalog, Amazon has poured billions into optimizing their site for conversions and you earn a commission for any product purchased visitors purchase within 48 hours of clicking your links, so they’re still a top recommendation for physical affiliate products.

Learn more about making Amazon Associates work for your audience and business in my Amazon Affiliate Marketing Program guide here.

Fiverr Affiliates

Fiverr, the popular marketplace for freelance services, offers a few different affiliate products and services that might be a good fit for promoting to your audience.

These include:

- Fiverr, the freelance marketplace offering services for everything from graphics and copywriting to complete websites and custom apps.

- Fiverr Business, their suite of premium tools and vetted talent for business owners.